A Quick Introduction

We provide free protest services to our property tax loan clients because reducing future tax bills is a key component of eliminating property tax debt.

Never leaving your property tax bill unpaid is the key step that you need to take in order to ensure that you’re never paying the tax collector more than you have to. So, if you’ve already utilized a property tax loan from us to achieve that savings goal, congratulations. You’re well on your way to taking control of your property tax bill already. But there’s another piece to the Texas property tax puzzle that we need to talk about, and that’s the reality of property tax protest.

“What are property tax protests and when do they take place?”

Every year at Springtime, you receive a notice of appraised value from your local appraisal district, and that value directly impacts the amount of your upcoming tax bill in the Fall. For most property owners, they accept that value as gospel and hunker down in preparation for what’s to come. But, what if that value is too high? That means that your tax bill (which is calculated based off that appraisal number), will also be too high. Every single year, hundreds of thousands of Texas property owners just pay the bill without ever considering that they might be just handing extra money to the government.

In Texas, a property tax protest is your legal right to challenge the appraised value of your property and potentially have it lowered. It’s a formal process that allows you to present evidence and argue that the appraisal district’s valuation is incorrect. If you want to make sure that you’re not being taxed unfairly, you have to file a protest every single year. It starts with filing protest paperwork, an informal hearing, and ultimately leads to more formal proceedings. Technically, property tax protests can wind up in court if the stakes are high enough. That’s more common for higher value, commercial property though. It’s far less common for it to go that far for residential homes.

Every Spring, tens of thousands of wise Texas property owners prepare to begin the process of protesting (appealing) their property tax bill.

“Should I protest my Texas property taxes?”

Protesting your property taxes can potentially lower your tax bill. Lowering your tax bill means that you owe less money. Owing less money means that you get in control of your property tax bill sooner.

When the appraisal district overvalues your property, you end up paying more in taxes than you should. Paying more in taxes than you should adds to your debt burden. Adding to your debt burden means that you wind up out of control, and your property taxes become a looming threat year after year.

Here are some of the common scenarios that a protest can protect you from:

- Plain Overvaluation: The appraiser sets the appraised value for your property too high, for whatever reason.

- Unequal Appraisal: Similar properties in your neighborhood are appraised at a lower value.

- Errors in Appraisal: The appraisal district utilized data with mistakes in it in order to arrive at your appraised value, such as incorrect square footage or lot size.

- Damage or Depreciation: Your property has experienced damage or depreciation that was never accounted for.

While it may surprise you to hear, every property owner should consider protesting every single year. Even though there’s no guarantee in a property tax bill reduction, the cost of being overtaxed is simply too great of a risk.

A Key Consideration: A Property Tax Protest Cannot Result in a Bill Increase

An important thing to know about property tax protests is that they can only result in either a reduction to your property appraisal or a confirmation of the value. A property tax protest cannot result in an increase to your appraised value, so there’s no risk of an adverse outcome. Protesting is simply your right to challenge an appraisal for the purpose of moving it in your favor.

Conclusion:

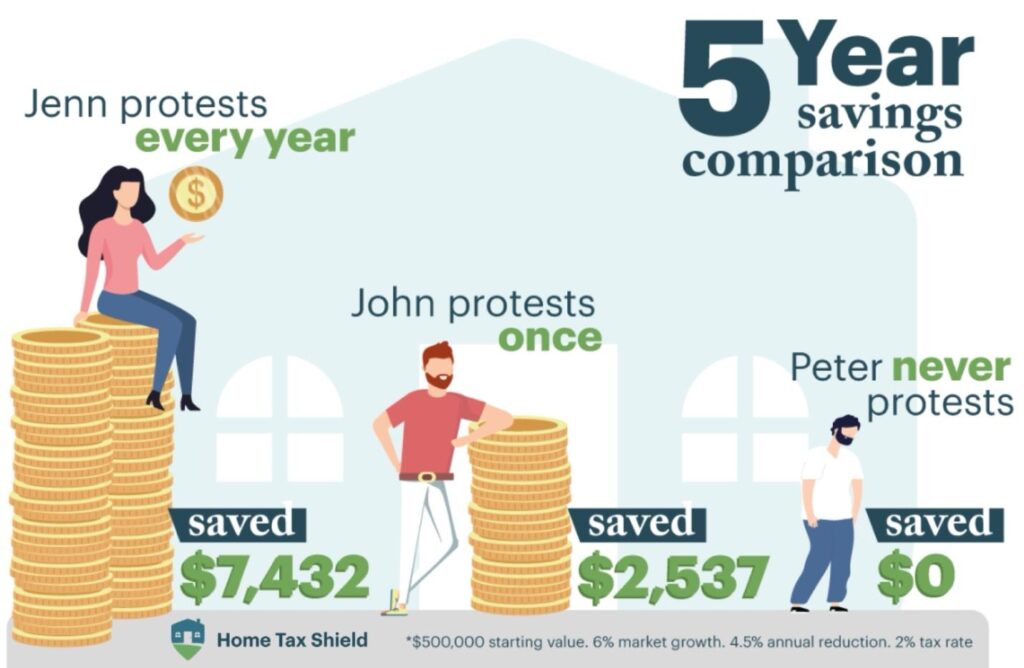

If you want to ensure that you’re not being unfairly taxed, you need to protest your property taxes every single year. Property appraisals are an inexact science and can easily result in over-taxation. The compounded savings that can be achieved from even small reductions in your assessed value can add up to be substantial amounts over time. You can do it yourself, but as you’ll soon learn, if you don’t have the time or expertise you can also have a professional do it for you.

Even though our core business is property tax loans, we don’t want our clients to miss out on the potential savings that a property tax protest can bring. More savings means less debt, which means that our clients get in control of their property tax bill sooner. Providing free property tax protest services is our way of ensuring that our property tax loan clients don’t miss on this often missed opportunity to save.

Stop overpaying your property taxes. Speak with tax expert to get a handle on your property taxes to help you keep more of your money.

All it takes is 30 seconds to provide your address and save money.